Doing Business Here

Local Incentives

The Stephens County Development Authority (SCDA) works closely with the Stephens County Commissioners, the Mayor and Council of Toccoa, local legislators and the Georgia Department of Economic Development to help craft incentive packages for new and existing businesses considering expansion.

SCDA is the primary conduit for a number of business incentives offered to qualified industrial prospects. These flexible incentives allow a relocating or expanding company to offset certain transition costs and risks associated with investing and creating jobs in Stephens County. Please contact our office if you would like to explore these opportunities in detail. Incentives offered through the state of Georgia and through the local community require signed performance agreements requiring companies to meet certain job and investment expectations.

Other incentives for choosing Stephens County

- Available land and buildings

- Infrastructure/grading assistance in SCDA industrial parks

- $4,000 tax credit per new job created each year for five years

- Excellent location

- Low cost of living

- Low housing costs

- Low transportation costs

- Well-trained and disciplined work force

- Low property taxes

- Excellent quality of life

Property Tax Abatement

Manufacturers, distributors and certain other qualifying businesses may be offered exemptions from local property taxes for a negotiated time period. This is based on the company’s commitment to the community in the form of new jobs and capital investment. The Development Authority has extensive experience with assisting companies in structuring this proposed tax incentive to comply with local, state and federal law.

Industrial Revenue Bonds

For qualifying projects and companies that obtain external letters of credit for collateral, the Stephens County Development Authority can assist by serving as a conduit for low-interest Industrial Revenue Bonds (IRBs).

Expedited Permitting

Certain projects require commitment from the local leadership to expedite permitting and plan review. To the extent allowed by local and state law, Stephens County will commit to assist with expedited permitting as needed.

Hospitality

A priority of the Stephens County Development Authority, the Stephens County Board of Commissioners, The City of Toccoa and the Toccoa-Stephens County Chamber of Commerce is to work together to recruit a hotel to our community.

In our efforts to accomplish that goal, the Board of Commissioners and The City of Toccoa split the cost in 2024 to have an updated hotel feasibility study completed to use in our recruitment process. You can see that study in the link below.

If you would like to work with us to open a hotel in Toccoa-Stephens County we would love to further explore that with you. Here is to the possibility of working together to grow Toccoa-Stephens County!

Workforce

STEPHENS COUNTY OFFERS A SKILLED WORKFORCE

Stephens County offers existing businesses and new companies a skilled workforce of nearly 50,000 people within easy commuting distance — a rich pool of experience from which companies can draw. Our current workforce is helping international, national, regional and local companies with a wide variety of industries.

Skilled workers are an asset for any business and they play a large role in developing a business’s reputation and ongoing success. The men and women in our skilled workforce have the necessary qualifications, and they consistently go above and beyond in the performance of their duties. From striving to provide an outstanding customer experience, to ensuring that all work is carried out with care and attention to detail, skilled workers understand their role and are fully committed to your businesses

Quick Start

Georgia is where people want to work – especially young people. No state does more than Georgia to ensure workers meet the needs of companies in Georgia — and Georgia Quick Start, has the No. 1 ranking to prove it.

Georgia Quick Start has trained more than a million employees. Each training regimen is designed around the unique needs of each employer. The training is an in-kind, discretionary incentive to eligible, job-creating businesses in the state.

Skilled workers are an asset for any business and they play a large role in developing a business’s reputation and ongoing success. Skilled workers have the necessary qualifications to perform their roles, and they consistently go above and beyond in the performance of their duties. From striving to provide an outstanding customer experience to ensuring that all work is carried out with care and attention to detail, skilled workers understand their role and are fully committed to your businesses

Georgia’s internationally-acclaimed workforce training program, provides customized training free-of-charge to qualified new, expanding and existing businesses. Additionally, the economic development offices at each technical college work everyday to make sure their local companies have the customized, contract training they need to keep their workforces’ skill up-to-date and cutting edge.

Worksource

Stephens County offers the added benefit of participating in WorkSource Georgia Mountains (WSGM), a program federally-funded to provide education and training to eligible individuals to enhance their current skills or learn a new trade.

Under the leadership of the Georgia Mountains Regional Commission and the Technical College System of Georgia, the goal of WorkSource Georgia Mountains is to build a world-class workforce that:

~ Enables individuals to achieve their highest potential

~ Ensures employers have the skilled workers they need to compete effectively in the global economy

~ Capitalize on the untapped potential of underemployed and dislocated workers, youth, and other job seekers with special needs

WorkSource Georgia Mountains provides funding for education and training to eligible individuals to enhance their current skills or learn a new trade. The program also supplies funding and services for Georgians who lose their jobs as a result of plant closures, mass layoffs, and other effects of the changing economy. WSGM assists with educational expenses (tuition, fees, books, required supplies, gas, and childcare) for up to two years.

State Incentives

Georgia’s business tax environment benefits companies in so many ways. The state’s corporate tax rate has been kept low for 50 years, and your tax obligation is based on one factor: your sales inside Georgia. The rate was recently reduced from 6 percent to 5.75 percent. When you learn about job tax credits and other incentives, you’ll know why so many view Georgia as good for business

Freeport Inventory Tax Exemption

Georgia businesses pay no state property taxes on inventory held in their factories and warehouses. Stephens County offers a 100 percent Freeport Exemption on all qualifying inventories in three categories.

A Freeport Exemption may exempt the following types of tangible personal property:

- Inventory of finished goods manufactured or produced in Georgia held by the manufacturer or producer for a period not to exceed 12 months.

- Inventory of finished goods on January 1 that are stored in a warehouse, dock, or wharf that are destined for shipment outside of Georgia for a period not to exceed 12 months.

- Inventory of goods in the process of being manufactured or produced including raw materials and partly finished goods.

Freeport Inventory Tax Exemptions are processed by the Stephens County Tax Assessor’s Office and completed forms must be filed between January 1 and April 1.

Sales and Use Tax Exemption

Sales and Use Tax Exemption – Qualified equipment purchases or leases are exempt from sales tax when the equipment purchased is used in the manufacturing process. Under certain conditions, primary material handling equipment (in warehouses and distribution centers), computer equipment and Class 100 (or less) clean room machinery, equipment and materials may also be exempt.

Foreign-Trade Zone (FTZ) – Georgia is home to multiple FTZ sites and is a recognized leader in working with companies to facilitate use of the program. Importing and exporting are central to many businesses’ success, and the program streamlines those activities and lowers costs. The FTZ program allows qualified companies to defer, decrease, or eliminate duties on materials inported from overseas that are used in products assembled in Georgia.

Georgia Tax Credits

Single Factor Apportionment — The state’s “Single Factor Gross Receipts” apportionment formula treats a company’s gross receipts, or sales, in Georgia, as the only relevant factor in determining the portion of that company’s income subject to Georgia’s 5.75 percent corporate income tax. Single Factor Apportionment significantly reduces the effective rate of Georgia income taxation of companies with substantial sales to customers outside Georgia.

Corporate Tax Credits – Georgia offers a range of corporate tax credits that enable companies to minimize or completely eliminate state corporate income taxes, which, at 5.75 percent, are already among the lowest in the nation.

Job Tax Credit – Companies and their headquarters engaged in strategic industries such as manufacturing, warehousing and distribution, processing, telecommunications, broadcasting, tourism, and research and development may qualify for Georgia’s Job Tax Credit Program. Depending on the community’s tier, companies must create between five and 25 net new full-time jobs in the first year to qualify. An additional $500 credit is offered in counties like Stephens that participate in a multi-county Joint Development Authority (JDA).

In Stephens County credits may be taken against 50 percent of state corporate income tax liability. Credits claimed but not used in any taxable year may be carried forward for 10 years.

Port Tax Credit Bonus – The Port Tax Credit Bonus is available to taxpayers who increase imports or exports through a Georgia port by 10 percent over the previous or base year. The port tax credit bonus can be used with either the Job or the Investment Tax Credit program, provided that the company meets the requirements for one of those programs. Port Tax Credits may be used to offset up to 50 percent of the company’s corporate income tax liability.

Even More State Credits

Port Tax Credit Bonus – The Port Tax Credit Bonus is available to taxpayers who increase imports or exports through a Georgia port by 10 percent over the previous or base year. Port Tax Credits may be used to offset up to 50 percent of the company’s corporate income tax liability.

Quality Jobs Tax Credit – Companies that create at least 50 jobs in a 12-month period where each job pays wages at least 110 percent of the county average are eligible to receive a tax credit of $2,500-$5,000 per job, per year, for up to five years.

Research and Development – Georgia offers an incentive to new and existing business entities performing qualified research and development in Georgia. The R&D credit is applied to 50 percent of the company’s net Georgia income tax liability after all other credits have been applied.

Mega Project Tax Credit – Companies that employ at least 1,800 new employees, and either invest a minimum of $450 million, or have a minimum annual payroll of $150 million, may claim a $5,250 per job/per year tax credit for the first five years of each net new job position.

Child Care Tax Credits – Employers who purchase or build qualified child care facilities are eligible to receive Georgia income tax credits equal to 100 percent of the cost of construction spread over 10 years.

Work Opportunity Tax Credit Program (WOTC) – The Georgia Department of Labor (GDOL) coordinates the federal Work Opportunity Tax Credit Program, a federal tax credit incentive that the U.S. Congress provides to private-sector businesses for hiring individuals from nine target groups who have consistently faced significant barriers to employment.

Hiring, Training and Education

Hiring Assistance – Georgia’s Department of Labor (GDOL) assists companies in recruitment by posting job notices, collecting and screening applications and/or resumes, providing interview space, scheduling interviews and hosting job fairs. GDOL will work with private employment agencies that list jobs with the state.

Retraining Tax Credit – A company’s direct investment in training can be claimed as a tax credit. The credit is available to all Georgia businesses that file a Georgia income tax return. 50 percent of the employer’s direct cost, up to $500 per full-time employee, per approved training program, may be claimed as a credit. The total amount of credit cannot exceed $1,250 per employee per year. Training programs must be approved by the Technical College System of Georgia. The retraining program must be for quality and productivity enhancements and certain software technologies. This tax credit can be used to offset up to 50 percent of a company’s state corporate income tax liability. Unused credits can be carried forward 10 years. These credits can be combined with other tax credits.

HOPE Scholarship and Grant – The HOPE Scholarship provides tuition assistance at one of Georgia’s 35 public colleges or universities for graduating Georgia high school seniors with a B or better average. The HOPE Grant provides an opportunity for all Georgians to receive a degree or certificate programs at a low cost through Georgia’s technical colleges and schools. These programs can be advantageous to relocating families with children, and for a company training employees through local technical colleges.

WorkSource Georgia Mountains — This federal grant program provides funding for education and training to eligible individuals to enhance their current skills or learn a new trade. Funding and program services are also available for Georgians who lose their job as a result of plant closures, mass layoffs, and other effects of the changing economy. To receive assistance from the WorkSource Georgia Mountains grant, you must live in, or have been laid off from employment in one of these 13 counties: Stephens, Banks, Dawson, Forsyth, Franklin, Habersham, Hall, Hart, Lumpkin, Rabun, Towns, Union or White.

Quick Start Employee Training

Georgia’s Quick Start Program is the number-one workforce training program in the country. Since 1967, more than 3,700 companies and 390,000 Georgia workers have benefited from this no-cost program.

Quick Start develops and delivers customized training for new employees in skill-based jobs at no cost to qualified companies investing in Georgia. The program’s services are provided free of charge as a discretionary incentive for job creation for clients. This includes opening or expanding manufacturing operations, distribution centers, headquarters operations and customer contact centers in a broad range of industries. Quick Start helps companies assess, select and train the right people at the right time for success. The program provides training space, instructors and all needed materials related to the program, potentially saving companies millions of dollars in training costs. The training program is given to the company for its future use.

You can accelerate employee training and lower expenses by utilizing the customized job-specific training and orientation available through Georgia’s Quick Start program. It is administered by the Georgia Department of Technical and Adult Education (GDTAE) and provides flexible, customized training through North Georgia Tech, a statewide network of technical colleges, multiple satellite campuses and four associated universities. Recognized by such publications as Expansion Management and Fortune, Quick Start has offered services ranging from company orientation to advanced manufacturing technology training to productivity enhancement.

Corporate Net Worth Tax

Corporations that own property or do business in Georgia may have to pay a net worth tax. This tax is based on the net worth of a corporation, levied in exchange for the privilege of doing business or exercising a corporate franchise in Georgia. Corporations with a net worth of $100,000 or less are not subject to tax but must file a return. The maximum tax is $5,000 for a net worth in excess of $22 million. All corporations doing business in Georgia for the first time must file an initial net worth return

Unemployment Taxes

Georgia’s unemployment insurance law is administered by the Georgia Department of Labor. For new employers, the tax rate is 2.7% and can be adjusted after an unemployment history for the company is established. For more information, visit the Georgia Department of Labor’s website.

Financing

LOANS, GRANTS AND OTHER FINANCE OPTIONS

If your company is looking for support for infrastructure development, workforce training or financing, please let us help you explore the state, federal, and private financing resources. Our office is qualified and experienced to assist in accessing these funding sources to support new and expanding business opportunities.

The following is a partial listing of financing and funding resources that have been used successfully to support new and expanding businesses. This information is subject to change, so please check with us or the agency involved for the latest assistance plans available.

Appalachian Regional Commission Loan Fund

Private, for-profit businesses that create or retain at least one job per $20,000 of RLF loan funds received may qualify for financing. Funds may be utilized for working capital, new construction, rehabilitation, building and land acquisition, equipment purchase and installation, as well as façade improvements. Business owners must arrange financing for at least 50% of the cost of their proposed project.

Community Development Block Grant

The Georgia DCA Redevelopment Fund finances local public/private partnerships to leverage investments in downtown and industrial redevelopment projects. This is incumbant upon necessary job creation and private investment goals being met. The local government can apply for a $500,000 grant, which in turn may be loaned to a private company at a low interest rate for fixed asset acquisition and/or rehabilitation. Many smaller scale projects (in downtown areas, blighted industrial areas, etc.) are compete for Redevelopment Fund financing.

CDBG Employment Incentive Program

EIP financing of up to $500,000 may be available for projects creating opportunities for low and moderate income persons. This program is used to obtain employment, greater job security, better working conditions, job training, enhancement of workplace skills and advancement opportunities. The funds would be available through the City, and eligible for loan to a private entity at low interest rate for fixed asset financing. In addition to meeting low and moderate income job creation requirements, the company must provide a minimum private investment of $500,000 and create at least 50 jobs.

OneGeorgia Authority Equity Grant

Up to $500,000 and up to $200,000 may be available for a single county benefit. Eligible uses of funds provided under the Equity Fund include, but are not limited to the following: the provision of public infrastructure, services, facilities and improvements, technology infrastructure, the acquisition, clearance and disposition of real property, site preparation, site improvements, real property rehabilitation, and the provision of planning services and technical assistance.

USDA Rural Development

B&I Guaranteed Loan Program – Up to $10 million loan by USDA Rural Development – B&I (Business & Industry) loans are available in rural areas of less than 50,000 population (Stephens County qualifies). Loan purposes include:

- Business and industrial acquisitions when the loan will keep the business from closing, prevent the loss of employment opportunities, or provide expanded job opportunities.

- Business conversion, enlargement, repair, modernization, or development.

- Purchase and development of land, easements, rights-of-way, buildings, or facilities.

- Purchase of equipment, leasehold improvements, machinery, supplies, or inventory.

The maximum percentage of guarantee is 80% for loans of $5 million or less and 70% for loans between $5 and $10 million. The total amount of Agency loans to one borrower must not exceed $10 million.

Transportation

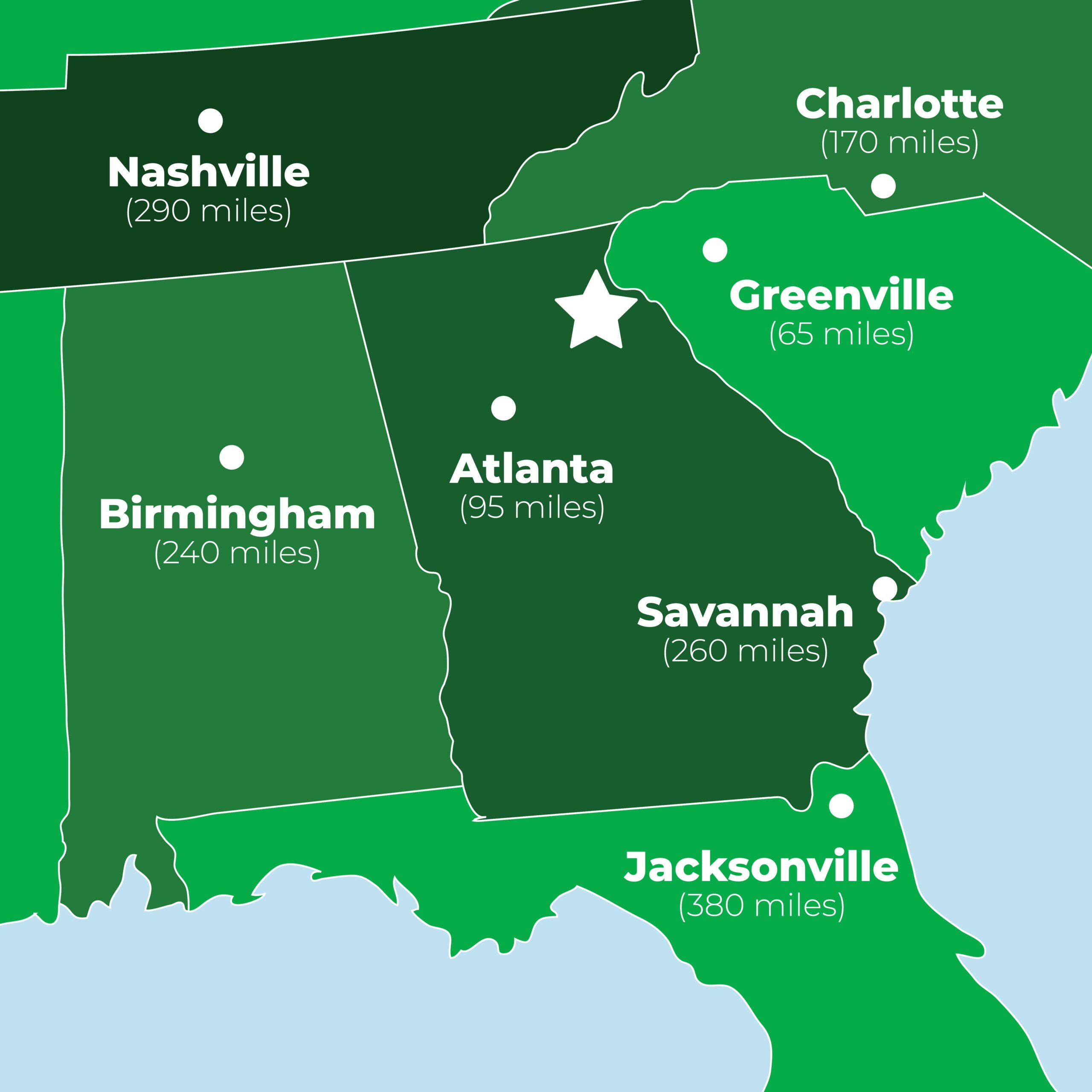

IT'S EASY TO GET THERE FROM HERE

Affordable and accessible transportation is essential for businesses, especially manufacturers, to have ready access to get raw materials in and finished products out. Stephens County is perfectly situated for your business to access markets near and far.

The growing I-85 corridor between Atlanta and Charlotte offers many advantages for businesses. Most Stephens County industrial sites are six to 15 miles to the interstate, making transport easy in this affordable business location. The Georgia widening project will offer four-lane unobstructed delivery access between your company and I-85.

Georgia Hwy. 17 is on the state’s official “Freight Corridor Network” and is four lanes from Stephens County to I-85. The Freight Corridor Network presents a cohesive and complete map of the state’s priority of roads for freight movements and highlights the key strategic highway routes that handle the flow of freight to and from locations in Georgia.

Central Location in Tri-State Area

- Three miles from Highway 365 / 441 between Atlanta and Greenville

- 169 miles to Charlotte, NC

- 64.5 Miles to Greenville, SC

- 93.7 Miles to Atlanta GA

Close to Interstate 85

- Six miles from Hayestone Brady Business Park

- 12 Miles from Meadowbrook Industrial Park

- 18 Miles from Downtown Toccoa

Highways in Stephens County

- US 123 and State Highways:

- 106, 365, 63, 328, 17

- 184, 145, 105 and 17A.

Distribution Convenience

- Toccoa manufacturers & distributors are 2 truckload days or fewer from:

- 82 percent of the U.S. Industrial Market

- 79 percent of the nation’s largest consumer markets

- 77 percent of the U.S. metropolitan buying power

Rail Transportation

Stephens County is served by both the shortline Hartwell Railroad and a mainline of Norfolk Southern Railroad between Birmingham, AL, and Charlotte, NC. Additionally, Toccoa is the only city in the seven-county area of Northeast Georgia with an AMTRAK stop; the Stephens County Train Depot celebrated 30 years of AMTRAK’s Crescent Line service in 2009.

Rail Accessible Sites and Buildings

135,321 SF — Toccoa Casket Company

59,000 SF — Currahee Street

320 Acres Available — Hayestone Brady Business Park

30.34 Acres — Wolf Pit Road

30 +/- Acres — Hwy 145

13.32 Acres — Hwy 123

9.31 Acres — Hwy 17

Air Transportation

Local Airport – R.G. LeTourneau Field (IATA Airport Code: TOC)

With a runway length of 5,003 feet, R.G. LeTourneau Airfield is located two miles from Downtown Toccoa. It has two recently re-surfaced runways which can accommodate small jets. The Toccoa-Stephens County Airport Authority received a OneGeorgia EDGE Grant in December 2009 which was used to assist with construction of a 5,948 SF terminal facility at R.G LeTourneau Field. The airport is centrally located near the Georgia and North/South Carolina borders and serves as a gateway to the Northeast Georgia Mountains. This Level II airport handles comparable traffic to other Level III airports (Cornelia, Blairsville) and is Georgia’s northernmost airport before entering mountainous terrain, serving as a hub for Blue Ridge and Smoky Mountain tourist traffic.

Commercial Airport – Greenville, SC (IATA Airport Code: GSP)

Located just 63 miles from Toccoa on Interstate 85, the Greenville-Spartanburg International Airport serves the region by offering flights to locations across the U.S.

International Airport – Atlanta, GA (IATA Airport Code: ATL)

Located 91 miles from Toccoa, Hartsfield-Jackson Atlanta International Airport is the world’s busiest airport, serving as a valuable hub connecting various cities and countries around the globe.

Ports are Easily Accessible

Georgia and South Carolina have accessible port facilities offering first rate services to and from locations worldwide. The closest ports to Toccoa are the inland Port of Columbus (204 miles), the Port of Savannah (207 miles), and Port of Charleston (277 miles) on the Atlantic coast.

Port of Savannah

The Port of Savannah is located on the Atlantic Ocean in Georgia and specializes in the handling of container, reefer, breakbulk and RoRo cargoes. The Port has two terminals, Garden City Terminal and Ocean Terminal. Garden City Terminal is the 4th largest container port in the U.S. Both terminals are served by Norfolk Southern Railroad and Interstates 16 & 95.

Port of Charleston

The Port of Charleston is located on the Atlantic Ocean in South Carolina. The Port’s five terminals have the deepest channels on the South Atlantic coast, routinely handling post-Panamax ships and vessels drawing up to 47 feet of water. The port is served by Norfolk Southern Railroad and is accessible by Interstate 26, which links directly to Interstate 85.

Port of Columbus

The Port of Columbus is located in Georgia on the Chattahoochee River with access to the U.S. Gulf via the Tri-Rivers System. The facility is equipped to handle liquid bulk cargoes via barge traffic. The port is served by Norfolk Southern Railroad and is also accessible via Interstate 85.

Utilities

CLEAN WATER AND AFFORDABLE POWER AVAILABLE HERE

The Stephens County’s utility providers have developed systems with plenty of capacity to accommodate the most demanding industries. This includes electricity, natural gas, clean water, to extensive (and overlapping) internet connectivity. Additionally, many of our business parks and certified Pad-Ready sites have been built with infrastructure including water, sewer, power, natural gas, and a strong fiber network.

Electricity

GEORGIA POWER COMPANY

Georgia Power is an investor-owned, tax-paying utility that serves 2.35 million customers in all but four of Georgia’s 159 counties. The largest of four electric utilities that make up Southern Company, Georgia Power has been providing electricity to Georgia for more than a century at rates well below the national average.

HART EMC

Hart Electric Membership Coperative is a Touchstone Energy® Partner and is a member-owned electric membership corporation providing service to the people of Georgia in Hart, Stephens, Franklin, Madison, Banks, and Elbert counties.

Natural Gas

TOCCOA NATURAL GAS

Toccoa Natural Gas is a regional natural gas utility serving more than 7,000 residential and commercial customers from more than 90 miles of pipe running through seven counties in Georgia and North Carolina.

Broadband Services

MULTIPLE PROVIDERS

Three companies provide high speed internet connections.

- Windstream: 800-501-1776

- TruVista Communications: 706-886-2727

- North Georgia Network: 706-754-5323

Water and Sewer

CITY OF TOCCOA

The City of Toccoa provides water and wastewater service in Toccoa and Stephens County.

Solid Waste Disposal

STEPHENS COUNTY

Stephens County provides solid waste collection and disposal services for the unincorporated areas of the county with five convenience centers for household solid waste and a bulky item drop-off center for items too large for disposal at the convenience centers

Property Taxes

UNDERSTANDING PROPERTY TAXATION IN STEPHENS COUNTY

Property is assessed at 40 percent of fair market value in Stephens County and the rest of Georgia, unless otherwise specified by law. (O.C.G.A. § 48-5-7) The State Revenue Commissioner is responsible for examining the tax digests of counties in Georgia in order to determine that property is assessed uniformly and equally between and within the counties. (O.C.G.A. § 48-5-340)

Tax bills received by property owners include both the fair market value and the assessed value of the property. Fair market value means “the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arm’s length, bona fide sale.” (O.C.G.A. § 48-5-2)

Generally, Stephens County real estate and business personal property taxes are due by November 15. If taxes are not collected on the property, it may be levied upon and ultimately sold. Property tax collected by the local government is used to pay for the support of services provided by the Stephens County Board of Education, Stephens County and the State of Georgia.

Timber – Standing timber is not taxed until sold or harvested, at which time it is taxed based upon 100 percent of its fair market value. This value is then multiplied by the appropriate mill rate to determine the tax amount due.

Equipment, Machinery, and Fixtures –

Equipment, machinery, and fixtures are assessed at 40 percent of fair market value. The tax assessor may value the equipment, machinery, and fixtures of a going business to reflect the fair market value of the business as a whole. When no ready market exists for the sale of equipment, machinery, and fixtures, a fair market value may be determined by resorting to any reasonable, relevant, or useful information available. This information may include, but is not limited to, the original cost of the property, depreciation or obsolescence, and any increase in value by reason of inflation.

Property Tax Returns –

Property tax returns for real estate must be filed with the Stephens County Tax Assessor at the Courthouse between January 1 and April 1 of each year where property has changed or been acquired. The taxpayer may elect not to file a property tax return if they have no changes that would affect the value of their property from the previous year. Failure to file a required return will subject the taxpayer to a 10 percent penalty on the value of the property not returned, plus interest and possibly penalties from the date the tax would have been due.

Visit the Tax Commissioner’s website and the Stephens County Tax Assessors website for more information. The Georgia Department of Revenue sponsors a website with the non-annotated version of the Official Code of Georgia (O.C.G.A.).

Land Use and Zoning

ZONING, LAND USE AND BUILDING PERMIT ORDINANCES

The basic purpose and function of zoning is to divide a municipality into residential, commercial, and industrial districts (or zones). These are, for the most part, separate from one another with the use of property within each district being reasonably uniform. Land-use regulation is, in large part, designed to guide future development. Building permits and inspections are part of an overall process of guiding the construction of new homes, businesses and manufacturing facilities.

Land Use Regulations

Land use and zoning laws regulate the use and development of real estate. The most common form of land-use regulation is zoning. Zoning regulations and restrictions are utilized by counties and cities to control and direct the development of property within their borders. Since New York City adopted the first zoning ordinance in 1916, zoning regulations have been adopted by virtually every major urban area in the United States.

Stephen County’s land use regulation ordinance was created to promote “health, safety, convenience, order, prosperity and general welfare of the present and future inhabitants of Stephens County.” Along with this are other purposes which include:

- Promoting classification of land uses, distribution of land uses, land development and land utilization

- Protecting and promoting desirable living conditions and sustained stability of neighborhoods

- Prevention of incompatible uses

- Conserving and protecting the County’s precious natural resources while encouraging the efficient management of their uses

- Preservation of buildings, structures and uses in areas having national, regional, state or local historic or environmental significance

- Protecting rural character, farm land and open space

- Managing congestion on the streets

- Protecting property against blight and depreciation

- Maintaining the value of buildings

- Facilitating the adequate provision of transportation, water, sewage service, schools, parks, and other public requirements

- Improving the aesthetic appearance of the County

- Securing safety from flood, fire, panic and other dangers

- Promoting health and general welfare

- Providing plentiful light and clean air

- Securing economy in governmental expenditures

- Encouraging the most appropriate use of land and structures throughout Stephens County.

Permits and Inspection

The City of Toccoa and Stephens County further protect the integrity and safety of the county with required building permits and inspections. Building permits and subsequent inspections reduce the potential hazards of unsafe construction practices and ensure public health, safety and welfare of family, friends, visitors and potential or perspective buyers.

The City of Toccoa’s building permit costs are based on value of the property to be constructed. The city also requires permits for electrical, plumbing and HVAC projects with an additional fee.

Stephens County uses a one-permit building system for residential and commercial construction. This means the builder/owner pays all fees associated with the residential construction at the time the building permit is purchased.

All building permit fees must be paid in cash or check at time of issuance and any re-inspection fees must be paid before any Certificate of Occupancy, Certificate of Completion, or Temporary Certificate is issued. The fees may be adjusted by the Board of Commissioners or the Construction Board of adjustments from year to year.

Construction and building inspectors ensure new construction and renovation projects meet building codes and ordinances, zoning regulations, and contract specifications.

For more information visit the city and county websites:

You may also contact Stephens County Development Authority for assistance with these matters.